Taxation

Indian taxes are divided into two types: One is Direct Taxes and the other is Indirect Taxes. Talking about direct taxes, it is levied on the income that different types of business entities earn in a financial year. There are different types of taxpayers registered with the Income-tax department and they pay taxes at different rates.

Direct Taxes are again subdivided as

Personal Income Tax: The income-tax paid by individual taxpayers is the personal income tax. Individuals get taxed on the basis of tax slabs at different rates.

Corporate Tax: The income-tax paid by domestic companies, and foreign companies on their income in India is corporate income-tax (CIT). The CIT is at a specific rate as prescribed by the income tax act subject to the changes in the rates in the union budget every year.

1. What is income tax slab?

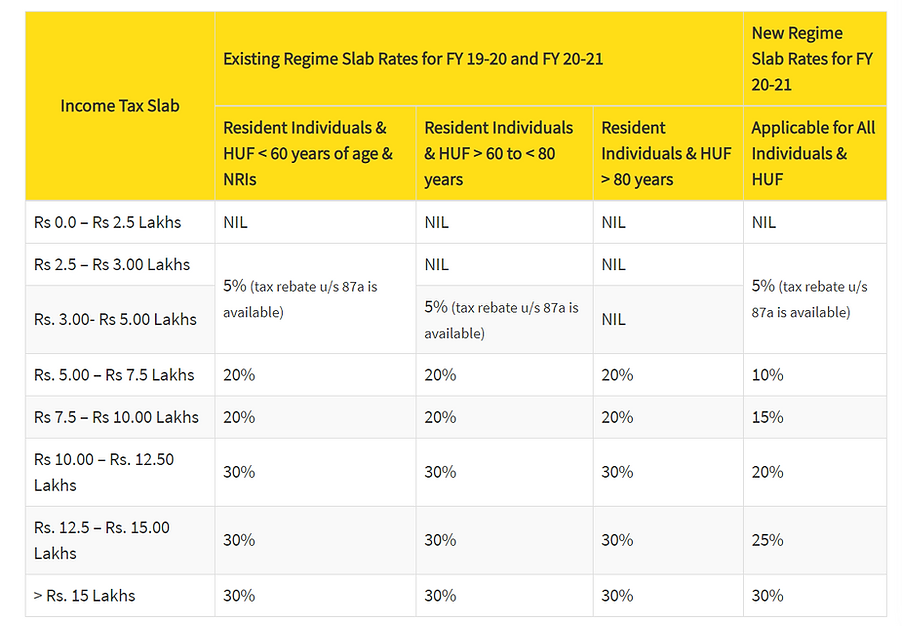

Indian Income-tax levies tax on individual taxpayers on the basis of a slab system. A slab system means different tax rates are prescribed for different ranges of income. It means the tax rates keep increasing with an increase in the income of the taxpayer. This type of taxation enables progressive and fair tax systems in the country. Such income tax slabs tend to undergo a change during every budget. These slab rates are different for different categories of taxpayers.

Income tax has classified three categories of “individual “taxpayers such as:

-

Individuals (aged less than 60 years) including residents and non-residents

-

Resident Senior citizens (60 to 80 years of age)

-

Resident Super senior citizens (aged more than 80 years)

2. Income Tax Slab Rates for FY 20-21 (AY 2021-22 )

.png)

.png)

3.Tax Rate For Partnership Firm:

A partnership firm (including LLP) is taxable at 30%.

Surcharge: 12% of Income tax where total income exceeds Rs. 1 crore

Education cess: 4% of Income tax plus surcharge

4.Income Tax Slab Rate for Local Authority:

A local authority is Income taxable at 30%.

Surcharge: 12% of Income tax where total income exceeds Rs. 1 crore

Education cess: 4% of tax plus surcharge

5.Tax Slab Rate for Domestic Company:

A domestic company is taxable at 30%. However, the tax rate is 25% if turnover or gross receipt of the company does not exceed Rs. 400 crore in the previous year.

.png)

Surcharge:

a) 7% of Income tax where total income exceeds Rs.1 crore

b) 12% of Income tax where total income exceeds Rs.10 crore

c) 10% of income tax where domestic company opted for section 115BAA and 115BAB

Education cess: 4% of Income tax plus surcharge

6.Tax Rates for Foreign Company:

A foreign company is taxable at 40%

Surcharge:

a) 2% of Income tax where total income exceeds Rs. 1 crore

b) 5% of Income tax where total income exceeds Rs. 10 crore

Education cess: 4% of Income tax plus surcharge

7.Income Tax Slab for Co-operative Society:

.png)

Surcharge: 12% of Income tax where total income exceeds Rs. 1 crore

Education cess: 4% of Income tax plus surcharge

Important tax forms

For individuals being a resident (other than not ordinarily resident) having total income upto Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest etc), and agricultural income upto Rs. 5000

For Individuals and HUFs not having income from profits and gains of business or profession

For individuals and HUFs having income from profits and gains of business or profession

For Individuals, HUFs and Firms (other than LLP) being a resident having total income upto Rs.50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE

For persons other than- (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-7

For Companies other than companies claiming exemption under section 11

For persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) only

Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically

Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, ITR4(SUGAM), ITR-5, ITR-6, ITR-7 filed and verified